The Tariff Storm: How Machining Navigates the Global Trade War

The $1 Trillion Hit

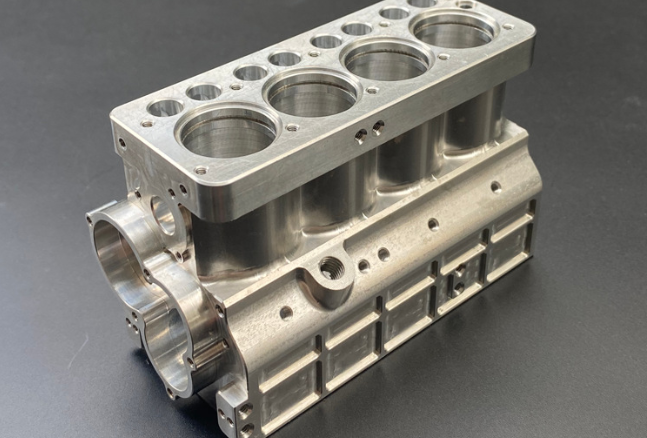

When the U.S. imposed 25% tariffs on Chinese imports, automotive manufacturers saw overnight cost surges of 21%, while electronics CNC machining plants faced 28% higher production expenses. Across industrial supply chains, companies scrambled to reconfigure sourcing, relocate factories, and absorb profit-crushing duties—all while racing to maintain precision standards for aerospace bearings or custom auto components

Trade wars transform machining from a technical craft into a geopolitical balancing act. For industries relying on micron-level precision—whether jet engine turbines or EV battery trays—the collision of tariffs, material shortages, and supply chain fractures demands unprecedented agilit

The Five Fronts of the Machining Trade War

A. Tariffs and Cost Volatility

Auto Parts Under Siege: A 25% tariff on Chinese imports slashes thin profit margins for transmission gears and brake calipers. Nearshoring to Mexico or Vietnam often lifts manufacturing costs by 18–30% due to inferior infrastructure and skilled labor shortages

Aerospace’s Double Bind: Aluminum alloy 7075—critical for aircraft frames—faced 10% U.S. tariffs. With 60% of global production linked to Chinese supply chains, manufacturers like Boeing and Airbus grappled with raw material costs spiking while FAA compliance deadlines tightened

B. Supply Chain Fragmentation

The 127-Day Squeeze: Automotive supply cycles collapsed from 127 to 95 days as companies regionalized hubs. Yet for CNC machining of turbocharger housings or fuel injectors, quality validation delays caused 40% of projects to miss launch windows

Inventory Paralysis: Toyota’s “just-in-time” model buckled. Tier-1 suppliers now stockpile 6–8 weeks of magnesium alloys (vital for gearbox castings), tying up capital and warehousing space

C. Technology Blockades

5-Axis CNC Lockdowns: Germany’s 2023 export restrictions on DMG MORI machines to China stalled aviation projects requiring ±0.0002-inch turbine blade tolerances. Domestic alternatives lagged in software integration and durability

Software Nationalism: CAM programs like Mastercam faced U.S. Department of Commerce audit requirements for Chinese aerospace customers. One Jiangsu-based aviation parts producer reported 14-week delays redesigning fan impellers on “approved” systems

China’s Counterstrike: Resilience Through Reinvention

A. Precision as Policy

The ISO9001 Surge: Suppliers like YQ-ChinaTransmissions implemented 9-step quality gates for non-standard customization of sprockets and couplings. Post-process inspections now include 3D coordinate measuring and salt-spray testing for 120-hour corrosion resistance—meeting German and Japanese OEM specs3.

EV Battery Machining Prowess: CATL’s battery enclosures use AI-driven CNC machining to achieve sealing surface flatness within 0.1 mm. AMTS 2025 will spotlight such innovations, with 70,000+ industrial supply professionals exploring China’s leap into EV precision

B. Domestic Material Sovereignty

Breaking the Aluminum Ceiling: China now produces 57% of global aluminum, with Henan Mingtai developing tariff-resistant aerospace-grade alloys. Aviation parts makers report 15% cost savings using domestic 7075-T6 substitutes410.

Rare Earth Leverage: Permanent magnets for EV motors (neodymium) face Western tariffs, but China’s control of 80% of refining forces auto parts giants like Tesla to localize rotor production in Shangha

The Adaptation Playbook: Surviving the New Normal

A. Customization at Scale

Dynamic Retooling: Shenzhen RapidCut prototypes BMW i-series control arms in 72 hours using modular CNC fixtures. Their cloud-based system auto-adjusts for 200+ non-standard customization parameters—material hardness, wall thickness, and bend radius7.

Digital Twins: GE Aviation’s Chengdu plant simulates CNC machining of combustors in VR, slashing trial errors by 70%. Real-time thermal modeling prevents warping in Inconel 718 superalloys

B. Co-Opetition Alliances

German Engineering + Chinese Agility: Volkswagen’s Anhui JAC plant uses Schuler presses (Germany) with Yaskawa robots (Japan) to CNC-machine EV chassis. Tariffs bypassed via bonded-zone assembly210.

ASEAN Bridge Builders: Thai industrial supply hubs like Hi-Speed CNC absorb 30% of redirected auto parts orders. Hybrid chains use Chinese billets + Thai finishing to cut EU duties by 19%

The Road Ahead: Re-globalization or Balkanization?

Zero-Tariff Experiments: China’s 0.1% duties on ASEAN goods boosted machining exports of aluminum radiator plates by 200% since 2010. Similar pacts with African nations secure cobalt for EV batteries

Distributed Manufacturing: Globe-spanning digital twins allow U.S. designers to oversee real-time CNC machining of titanium landing gear in Wuxi factories. Blockchain tracks every mill cut

“Trade wars don’t end manufacturing—they redirect it. The winners will master both the toolpath and the trade policy.”

Conclusion: Machining’s New World Map

The 2025 AMTS Expo epitomizes the shift: 800+ exhibitors—from Italian CNC spindle makers to Chinese battery tray specialists—will showcase tariff-proof economic and trade cooperation models. For auto parts needing ultra-polished camshafts or aviation parts demanding cryogenic-treated turbines, survival hinges on merging three pillars:

1 Material Innovation (e.g., localized rare earth processing)

2 .Agile Customization (cloud-controlled non-standard customization)

3 Alliance Architectures (German software + Thai labor + Chinese aluminum raw materials)

The future belongs to networked precision—where a CNC machining center in Suzhou, a Stuttgart QA lab, and a Detroit auto plant operate as one seamless industrial supply organism. In this recalibrated world, Made in China no longer means “cheap.” It means “adapt or die